STATUS OF COURT CASES AS ON 19.11.2025

The BSNL & MTNL Pension Revision matters were listed today as Item no. 58 & 61 today before the Hon’ble High Court in Court No. 4.

Senior Counsel Mr. Kirtiman Singh appeared on behalf of DOT. Mr. Ankur Chhibber appeared on behalf of the Private Respondents instructed by me. Senior Advocate Mr. Sanjoy Ghosh appeared on behalf of the private respondents in the other matter at Item No. 60.

The Arguments were held at length today and the principal objection raised by the DOT was as regards pension revision not being applicable in the absence of pay revision. Reference was made to Rule 37 A, circular dated 14.01.2002 and the impugned order as also the DoPPW order dated 08.03.2019. Mr. Ghosh responded to the queries raised by the bench which was initially not inclined to accept our submission since the pension revision had to be applicable on the last pay drawn.

Mr. Chhibber thereafter appeared and apprised the bench of all the relevant orders and OMs giving the government scheme of pension to BSNL/MTNL absorbed employees.

The Bench kept on seeking a query as regards the formula to be adapted in such a case upon which the Court was informed that the Order of the Tribunal left that aspect open. Mr. Chhiber then pointed out to the OM dated 04.08.2016 wherein the 2.57 was the multiplying factor and had to be used as the formula. The Court sought instructions whether we would be satisfied if the pension is revised on the 2.57 multiplying factor for pension basis the last pay draw. Mr. Kaushik who was present in Court gave me instructions to inform the bench that if the said formula applicable to central government employees is applied to the BSNL/MTNL absorbed employees for calculation of pension, they would be satisfied with the same. The Bench reiterated that it was in no way inclined to grant any pay revision, which aspect was anyway never raised by us and the Bench was therefore informed that only revision of pension was being sought. This was basis Rule 37A (8) wherein pension was to be calculated as per the formula applicable to the government employees. The statement was recorded and the Union of India was directed to take instructions on the same.

In view of the above, the matter is adjourned to 27.11.2025 in the supplementary list. In the event the DOT does not agree with that statement, the matter will then be heard on merits.

I would request again to kindly give me a comparison basis IDA pay scale (B.P + DA) and CDA pay scale (B.P.+D.A.) upon applying the 2.57 formula. In our rejoinder we had taken the formula as 2.51, we should just have this chart ready for the next date. Kindly provide the same to me at the earliest so that I can review it.

Should you have any clarification, please do not hesitate to contact me.

Warm regards,

Gauri

***

hese are results for difference between IDA (BP+DA) and CDA(BP+DA) with fitment formula 2.57 as per CCS pension rules

Comparision between CDA and IDA with fitment formuls.

The key difference is that CDA (Central Dearness Allowance) pension is based on Central Government pay scales and fitment formulas (like 2.57), while IDA (Industrial Dearness Allowance) pension is based on BSNL’s industrial pay scales and their own fitment formulas.

BSNL pensioners who were absorbed from the Department of Telecommunications (DoT) are covered by the Central Civil Services (Pension) Rules, 1972, specifically Rule 37A. This rule has been the subject of legal interpretations and debates regarding which pay scale (CDA or IDA) should be used for pension revision.

IDA vs. CDA Pension for BSNL Pensioners

CDA Pension (Central Dearness Allowance): This pension is calculated based on the pay scales and Dearness Relief (DR) patterns of the Central Government. The 7th Central Pay Commission (CPC) introduced a fitment factor of 2.57 to revise pensions for Central Government pensioners, which included the merger of 125% DA as on January 1, 2016. BSNL pensioners have been demanding that their pension be revised using this 2.57 formula, arguing they are Central Government pensioners under Rule 37A.

IDA Pension (Industrial Dearness Allowance): This pension is calculated based on the pay scales and IDA rates applicable to employees in Public Sector Undertakings (PSUs), which are generally higher than CDA scales. BSNL employees’ pay is revised based on the recommendations of the Pay Revision Committee (PRC) for PSUs, not the Central Pay Commission (CPC). The fitment factor in the 3rd PRC was around 2.52425 (based on 15% fitment on IDA scales).

CCS Rule 37A(8) and the 2.57 Formula Debate

CCS Rule 37A(8) states that the pension of an absorbed employee shall be calculated “in the same way as would be the case with a Central Government servant retiring or dying, on the same day”. This “explanation” has been a central point in legal cases.

The Argument for 2.57 (CDA): BSNL pensioners and their associations argue that, based on Rule 37A(8), their pension should be calculated using the same formula as a Central Government servant, which includes the 7th CPC fitment factor of 2.57.

The Counter-Argument (IDA): The Department of Telecommunications (DoT) has argued in court that since BSNL employees draw IDA pay scales, which are different and generally higher than the CDA scales, their pension should be revised according to IDA patterns and BSNL’s pay revisions. The fitment factor applied for BSNL pay revision (e.g., as per 3rd PRC) is what should apply to the pension, not the 2.57 factor.

In summary, the use of the 2.57 fitment formula is specifically for those under the CDA (Central Government) pension scheme, and its applicability to BSNL pensioners receiving IDA pay scales remains a matter of ongoing dispute and legal deliberation, centered on the interpretation of CCS Rule No. 37A. The pension amount is different under the two systems due to different pay scales, fitment formulas, and DA/DR rates.

Rule 37 PENSION RULE 2021 – Betanet

27 Sept 2025 — If a Central Government employee’s pay is revised on a certain date in a certain way, the same shall be applicable to BSNL absorbed DoT pensioners r…

betanet consultancy private limited

1 1. It is now more than six years now that we published our article in this …

occasion, now at least to the DoT it will be clear that the revision of pension of BSNL pensioners falls due only when pay revision takes place for serving empl…

AIBSNLREA CHQ

BSNL Pensioners – Facebook

10 Aug 2025 — *Status of pension revision case:- 19.11.2025.

***

17th. November, 2025

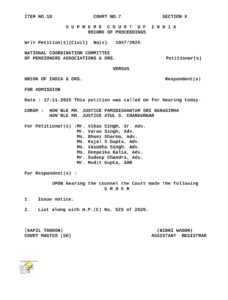

“STATUS OF CASE AGAINST THE VALIDATION CLAUSE IN HON’BLE SUPREME COURT – GOOD NEWS FOR THE PENSIONERS !”

Today, The case against Validation Clause has been admitted by the Hon’ble Supreme Court. Sh. Vikas Singh, Senior Advocate appeared and argued the case. In the arguments, he referred to the Nakara Case and the Government went for the Validation Clause from 1972.

The Hon’ble Supreme Court admitted our case and notice will be served to the Government respondents. It will be clubbed along with the S-30 Pensioners Association Case and will be argued.

This is the first victory. Let us hope that Justice will Win !

R. K. MUDGAL, G/S MREWA

***